- #Turbotax which version do i need how to#

- #Turbotax which version do i need full#

- #Turbotax which version do i need software#

Get matched with a dedicated small business tax expert, enjoy unlimited year-round advice and answers at no extra cost, and be confident that our small business tax experts will help you find every tax deduction and credit your business deserves. Online Desktop Help me choose Your security. It is easy to use, can cover almost any tax situation, and comes with a maximum refund guarantee.

#Turbotax which version do i need software#

(Think of a Schedule K-1 as the trust equivalent of a W-2. TurboTax is one of the most popular tax software programs in the United States. TurboTax Business also generates the trust beneficiaries' Schedule K-1 forms, which the beneficiaries then report on their personal tax returns.

Income Tax Return for Estates and Trusts), which is supported in TurboTax Business.

#Turbotax which version do i need full#

With NEW TurboTax Live Full Service Business, we enable the small business owner to be paired with a dedicated tax expert specializing in small business taxes to handle Partnerships (1065), S-corp (1120-S), and multi-member LLCs. All other trusts need to file Form 1041 (U.S. This is because the pass-through entity needs to complete their tax return before they can distribute K-1s to their recipients. Your Schedule K-1 may not arrive until March, April, or even later. Legislation requires partnership returns reporting K-1 tax information to be filed by March 15. The difference between receiving your W-2 and your Schedule K-1 is the timing in which you receive them. TurboTax is a market leader in its product segment. Each version includes the features found in the previous versions, so you can start your return online for. TurboTax is a software package for preparation of American income tax returns, produced by Intuit.

And if this reminds you that you need to complete your taxes, click here to get started.Ī: Schedule K-1s are issued by partnerships, S corporations, estates, trusts, and LLCs to their owners, shareholders, partners, and beneficiaries so the latter parties can report their share of income, deductions, and credits on their personal tax returns. Choosing the Best TurboTax Version for Your Needs. If you have questions about what a Schedule K-1 is, please check out our tax article here.

#Turbotax which version do i need how to#

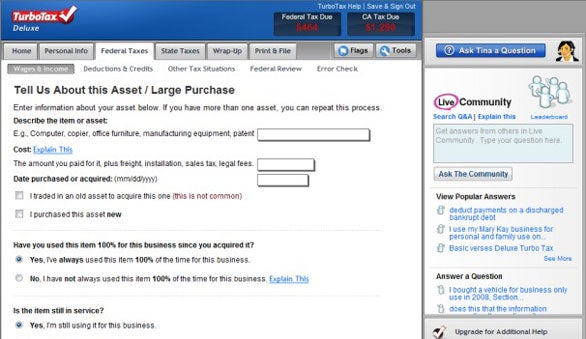

Tax season is here and every season we see questions about how to enter a Schedule K-1 in TurboTax, as well as what happens if you don’t receive your Schedule K-1 until after the tax deadline. Free Edition does not handle Capital Gains.

0 kommentar(er)

0 kommentar(er)